| বাংলায় পড়ুন | Researchers and Reporters: Tanzil Fuad Ayesha Maria |

On August 5, a student rebellion in Bangladesh brought down an authoritarian administration that had ruled the country for fifteen years. The “Bangladesh 2.0” emerged as a new Bangladesh. The recently overthrown administration left the nation with a debt of Tk 18 lakh 35 thousand billion. These loans came from a variety of local and international sources.

According to experts, Bangladesh’s economy is in a precarious state. By June 2025, GDP growth in Bangladesh is expected to have decreased from 6.6% to less than 6%.

According to experts, Bangladesh’s economy is in worse shape due primarily to inflation. The 12-year high for inflation was 11.66 percent in July 2024. where there was 14.1% annual food inflation. As an illustration, if you paid 100 taka for a product last year, you will have to pay 111.66 taka this year. In comparison, the cost of food jumped to 114.1 takas this year from 100 takas the previous year. Even Nevertheless, there has been a little decrease in the increase in food prices.

According to the banking position, more than half of Islami Bank’s loans have gone to S Alam Groupe. The S Alam Group withdrew foreign exchange worth Rs 18 crore in a single transaction. Once more, they took advantage of the bank and stole 80,000 crores under the guise of a loan. Over Tk, 1 lakh crore in loans has been taken out by S Alam Group overall.

Salman F Rahman, the founder of Beximco Group, is once more charged with stealing thousands of crores of taka through stock market manipulation and theft. He is also accused of stealing around 36,000 crores of taka from several public and private banks and smuggling them overseas. It can be concluded from all of this that Bangladesh’s economy is not particularly stable.

Professor Salim Raihan of Dhaka University’s Economics Department and Professor Kunal Sen of UNU University’s World Institute Development Economics Research have proposed a few strategies to deal with this precarious economic scenario, including:

- Inflation Control. 2. Refrain from taking out bank loans. 3. Loan recovery in default. 4. To lessen reliance on imports for the garments sector.

Let’s talk about Bangladesh’s present financial status now.

Examination of Inflation Rates:

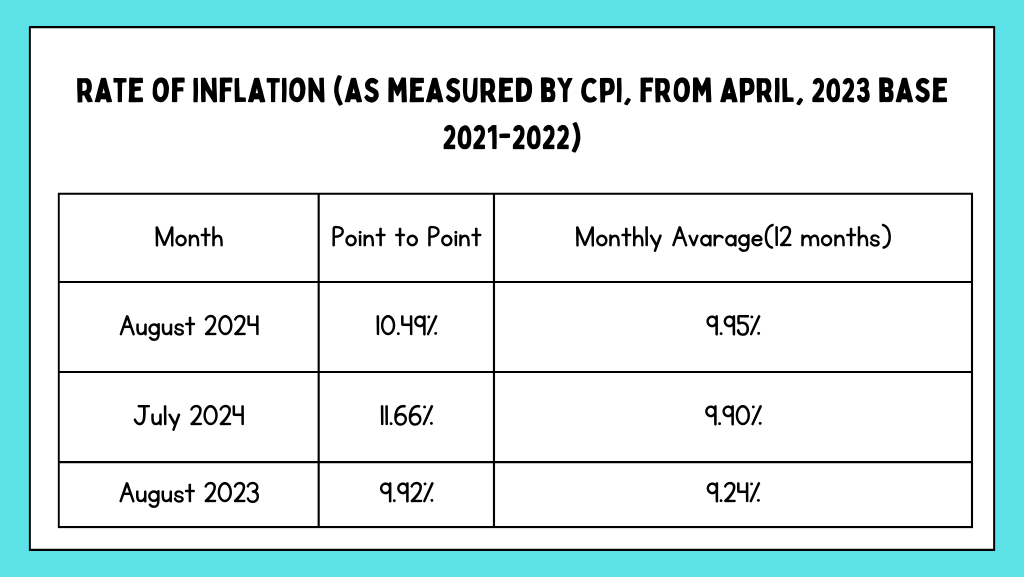

Economists maintain that a government should either raise its interest rates or make them market-based when inflationary pressure is high. That is to say, when someone applies for a loan, the bank significantly increases the interest rate, which causes people to start applying for fewer loans and therefore lowers the amount of money in circulation. Here is the CPI-observed inflation rate from August 2023 to August 2024.

Inflation rate trends reflecting the Currency State as of April 2023. | Photo: Collected.

In August 2023, the inflation rate was 9.92; by July 2024, it had risen to 11.66. Positively, however, the inflation rate dropped from 11.66 to 10.49 after the temporary government took office.

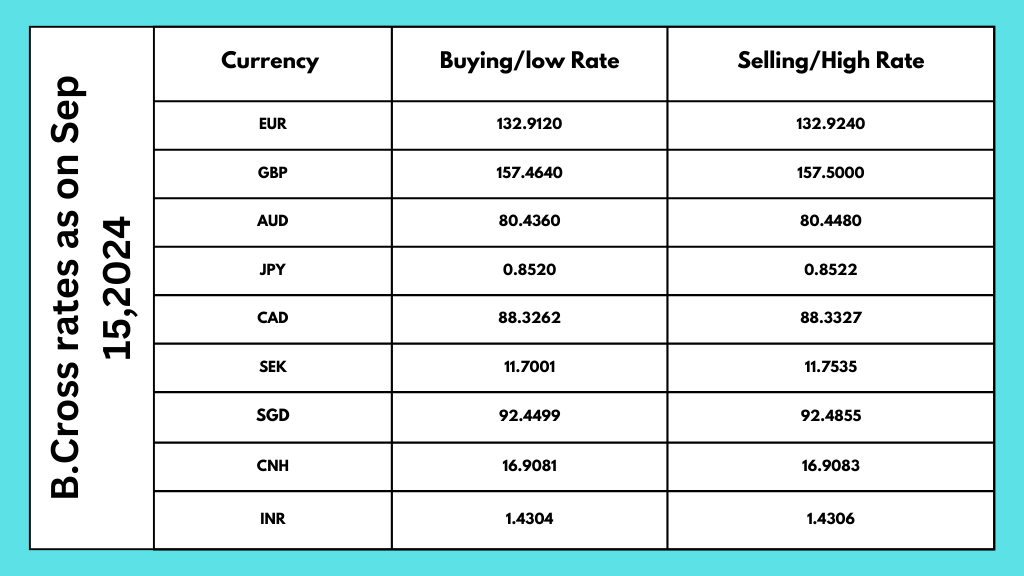

Upon examining the financial landscape in Bangladesh, it is evident that commercial banks determine the currency rate based on the interbank and client transaction balance between supply and demand. To maintain market equilibrium, Bangladesh Bank trades dollars with merchant banks at the going interbank exchange rates.

Bangladesh Bank transacts with the government and several international organizations at a discount. The lowest and highest exchange rates for buying and selling US dollars and Bangladeshi Taka between banks are listed here. The closing exchange rates in Dhaka and New York determine the cross rates between Bangladeshi and foreign currencies.

Cross rates overview reflecting the Currency State as of September 15, 2024. | Photo: Collected.

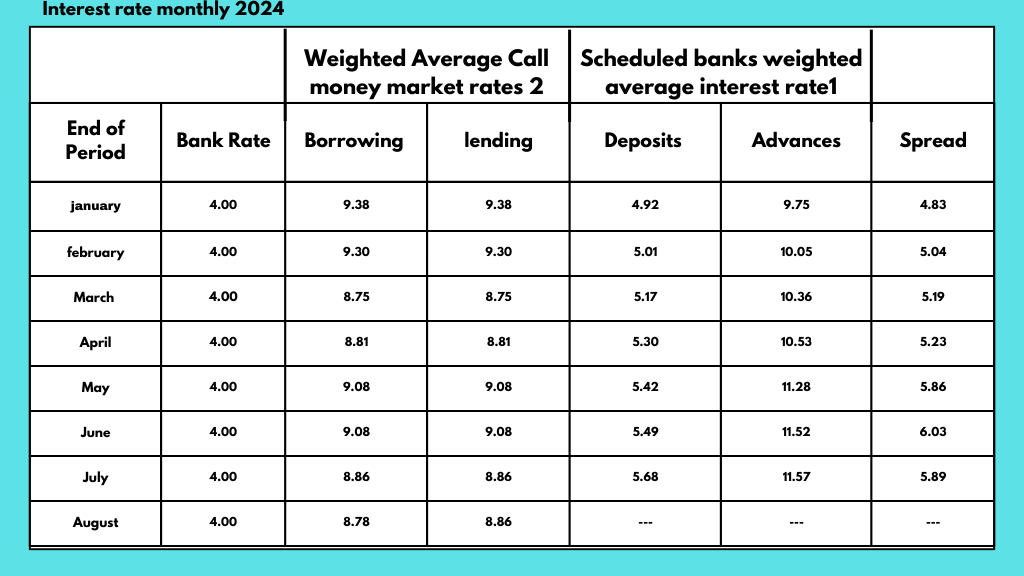

Monthly Interest Rate of Bangladesh Bank:

(Analysis using information from the circumstances in July and August of 2024)

Monthly interest rates set by Bangladesh Bank. | Photo: Collected.

According to the table, Bangladesh Bank provided other banks with an interest rate of 4 percent between January and August of 2024, and the average interbank transaction amount remained constant throughout this period. Based on the average interest rates for deposits and advances offered by the banks, it is evident that the bank’s profit rate was 4.83 in January of this year and 5.89 in July. This implies that the deposit rate rises when inflation falls and falls when it rises. Increasing the rate of return on deposits can help lower inflation by reducing the amount of money in the hands of the general people.

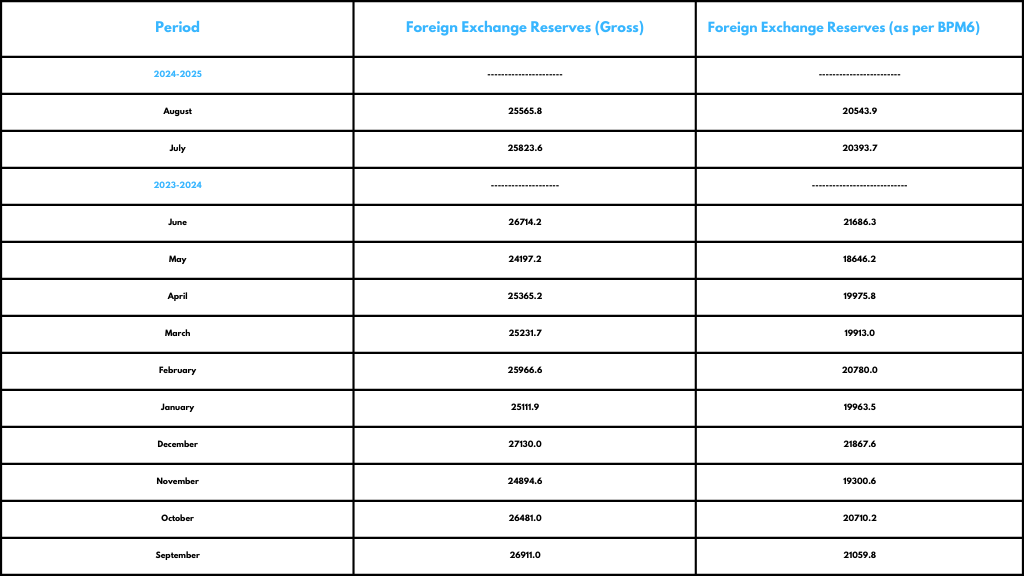

Reserve for Foreign Exchange:

Overview of foreign exchange reserves and the Currency State. | Photo: Collected.

It is reported that Bangladesh’s foreign exchange reserves, which were valued at 48 billion dollars in August 2021, dropped to just 18 billion dollars in May 2024. However, foreign reserves currently stand at $20.5 billion. But Bangladesh also required a loan from the IMF, the International Monetary Fund. It is common knowledge that Bangladesh’s economy is in rough shape, yet even though the previous administration received a Nobel Prize for corruption, things are still quite positive.

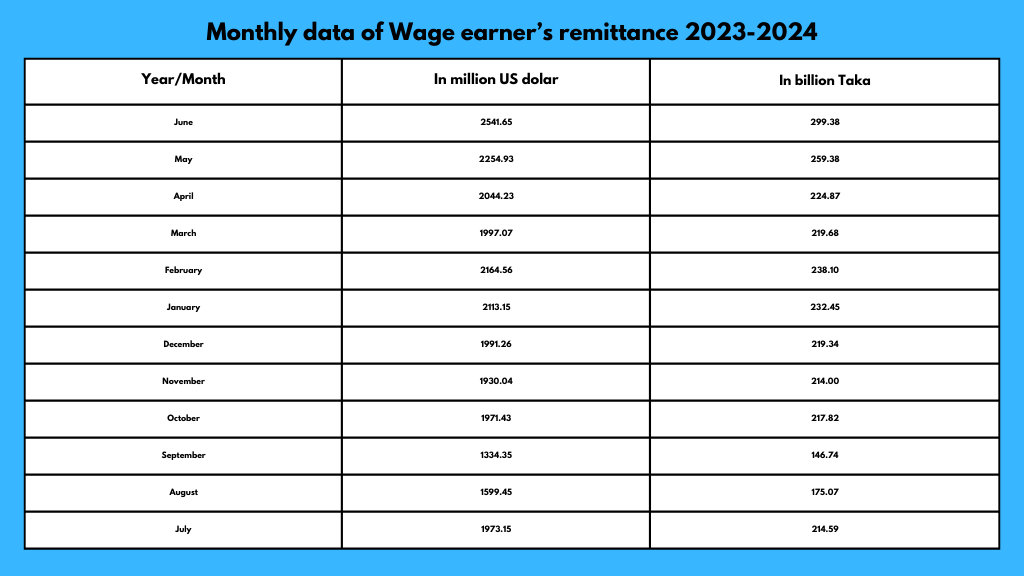

Remittance flow:

Husne Ara Shikha, Executive Director and Spokesperson of Bangladesh Bank, stated that the greatest factor driving the increase in foreign exchange reserves is the rise in expatriate income and remittance flow. He declared: “Bangladesh Bank’s reserves currently total $2,430 million. That is around two trillion dollars, based on the International Monetary Fund’s (IMF) BPM-6 approach. He added that with the dollar’s exchange rate currently set by the market and active interbank transactions, it is anticipated that the foreign currency market would stay stable.

Which we can know from the information given below-

Monthly wage earner’s remittance data reflecting the Currency State. | Photo: Collected.

The increase in expatriate income between July and August led to an increase in reserves and remittance inflows. As the numerous crises start to ease, banks can now buy and sell their currency. At the moment, one dollar is worth 118–120 taka. There is currently less than a 1% of discrepancy between the dollar price in the curb market and the banking channel.

Comments