| বাংলায় পড়ুন | Researchers and Reporters: Shama Sultana Isfaqul Kabir |

People refer to Warren Buffett as the “Oracle of Omaha.” He is a living legend in the investment industry in addition to being a wealthy investor. Millions of investors today are inspired by the extraordinary success he has attained in his role as Chairman and CEO of Berkshire Hathaway. Let’s examine some of the more profound facets of his investing philosophy and life.

The Importance of Value in Investing

In his investment philosophy, Warren Buffett has stated the straightforward but impactful maxim, “Price is what you pay, value is what you get.” In other words, the cost of an item does not always reflect its inherent worth. Selecting a business whose actual worth will rise in the future is a wise investment.

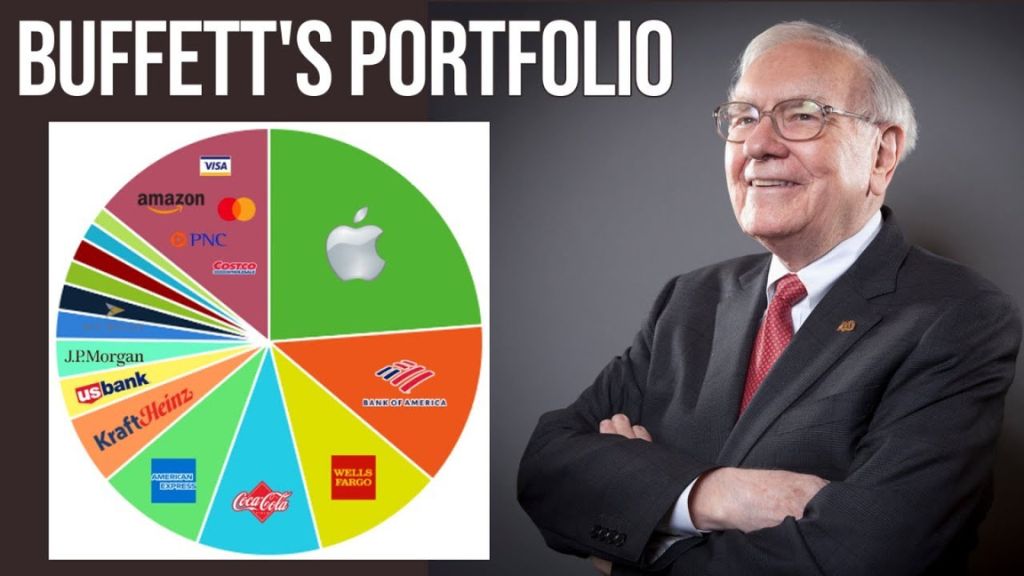

Investing in companies with strong financial standing, a solid reputation in the market, and a track record of sustained growth is essential to Warren Buffett’s long-term investment philosophy. Among Buffett’s most profitable investments are:

- Coca-Cola: Buffett made a roughly $1.2 billion investment in the company in 1988. Since Coca-Cola remains one of his most profitable assets to this day, it was one of his best choices. Over $25 billion is its current market value.

- American Express: Buffett invested $130 million in American Express in the 1960s. Consequently, Buffett has made numerous billions of dollars from the company’s stock price gain.

- Apple: In 2016, Buffett made an investment of almost $1 billion in Apple. With Apple stock, Buffett now makes billions of dollars annually.

- Bank of America: Buffett contributed $5 billion to the bank in 2011. Although the bank’s stock was cheap at the time, it has subsequently increased in value, and Buffett has now profited greatly from his investment.

These profitable ventures are a reflection of Buffett’s philosophy, which is to exclusively invest in dependable businesses with a solid market position and projected development. Over the years, this long-term investing plan has generated enormous profits, positioning him as one of the world’s wealthiest persons.

Warren Buffett – A symbol of the importance of values in investing, who has inspired the world of investments. | Photo collected.

Investing with awareness of fluctuations in the market

This is one of Buffett’s most well-known quotes: “Be fair when others are greedy and greedy when others are fair.” He thinks that a true investor should seek out opportunities while everyone else is panicked and dumping stocks.

He made investments, for instance, in firms like Bank of America and Goldman Sachs during the 2008 financial crisis. In the present day, those investments rank among his most profitable decisions.

Priority on quality in investing

Another of Warren Buffett’s favorite quotes is “The quality of a company is the most important thing in investing.” Purchasing a business at a low cost despite its shaky financial standing, in his opinion, can result in significant losses on the road.

Warren Buffett – Prioritizing quality in investing, who has inspired the world of investments. | Photo collected.

The Investment Guidelines of Buffett

Buffett’s success can be attributed to a number of his stringent investing guidelines, including:

- Never lose capital: His first and foremost rule of investing is, “Rule 1: Never lose money. Rule 2: Never forget Rule 1.” He advises avoiding risky investments and focusing more on capital protection.

- Long-term perspective: Warren Buffett considers his investments to be long-term. His methodical approach to investing is evident in this.

- Invest in what you understand: He thinks it is stupid to put money into a business or sector that you don’t fully comprehend. Buffett believes that wise financial decisions should be founded on thorough investigation and understanding.

Warren Buffett – Invest in what you understand: A testament to the importance of knowledge and awareness in investing. | Photo collected.

What made Buffett wealthy?

Buffett started investing while he was young. His financial knowledge has constantly increased since he purchased his first investment when he was eleven years old. He has made billions of dollars in earnings today from his investments in large corporations like Apple, Bank of America, and Coca-Cola.

Current investment strategy

Today, Warren Buffett continues to operate according to his basic values. His recent involvement in the technology industry, however, is noteworthy. His investments in businesses such as Taiwan Semiconductor, Amazon, and Apple suggest a change in strategy. Classic companies like Coca-Cola and oil and gas companies are still part of his portfolio. His basic beliefs—quality businesses and a long-term outlook—remain the same, though.

The investment philosophy of Warren Buffett teaches us the need for patience and foresight, alongside being a gauge of financial success. His life story and strategy for investing can serve as an inspiration for all of us. Buffett exemplifies that anyone can achieve the highest level of success with the correct information, diligence, and perspective.

Comments