| বাংলায় পড়ুন | Researchers and Reporters: Tanjil Fuad Anika Taieba |

While investing can be a very effective way to increase money, risks are involved. Unexpected incidents, economic downturns, and market fluctuations can all rapidly lower the value of your investment. Here’s when careful risk management is essential. To assist in guaranteeing the stability and expansion of investments, implementing a systematic approach for the early detection, evaluation, and reduction of risks entails.

Why Risk Management Is Important

Let’s examine the significance of recognizing and managing risks in the investment process. Effective risk management is fundamental to profitable investing. It assists in keeping prospective gains and losses in check, allowing investors to proceed with assurance despite the financial market’s unpredictability. Every investment carries some risk, but losses can be reduced and profits can be increased with effective risk management.

Key Advantages of Risk Management

1. Defense of Capital

Risk management’s primary objective is to safeguard investor capital. By recognizing possible risks and using mitigation techniques, investors can decrease the possibility of significant losses. Dollar-cost averaging and diversification, in particular, are good ways to safeguard investments during economic recessions.

2. An increase in self-assurance

Risk management boosts investors’ confidence while making investment decisions by giving them financial security and peace of mind. They can accomplish their long-term objectives more methodically because of this confidence.

3. Maintaining Continuity of Business

Businesses that manage risk can maintain technological stability. Through risk identification and mitigation, organizations can steer clear of serious issues like lost revenue or harm to their brand.

Effective strategies for ensuring business continuity through risk management. | Photo collected.

Strategies for General Risk Management

Now, let’s look at some broad risk management techniques you might use for your assets. There are several ways to lower risk:

For instance:

1. Diversification

Investments can be distributed among several asset classes or industries to lower the risk of loss. As an example, in addition to selling rice and pulses, a grocery store owner can also sell everyday essentials like shampoo and soap. This allows the profit from one sector to offset any losses in another.

2. Preventing and reducing losses

Stable investments like bonds and government treasury bills can be added to high-risk assets to keep the investment balanced.

3. Transfer and pooling of risk

Sharing risk amongst several people, like in partnerships or insurance. In addition, an insurance policy may shift risk to a third party. Compensation for the insured assets is made by the insurance company.

Risk Management Challenges

Despite its significance, risk management is not without its difficulties. As a reference,

1. Striking the correct balance: Investors may find it challenging to decide how much risk to take. While taking on too much risk might result in significant losses, being overly careful can restrict gains.

2. Cost: Time and money are required to put in place a strong risk management strategy.

Let’s now know of a massive risk-mismanagement scheme

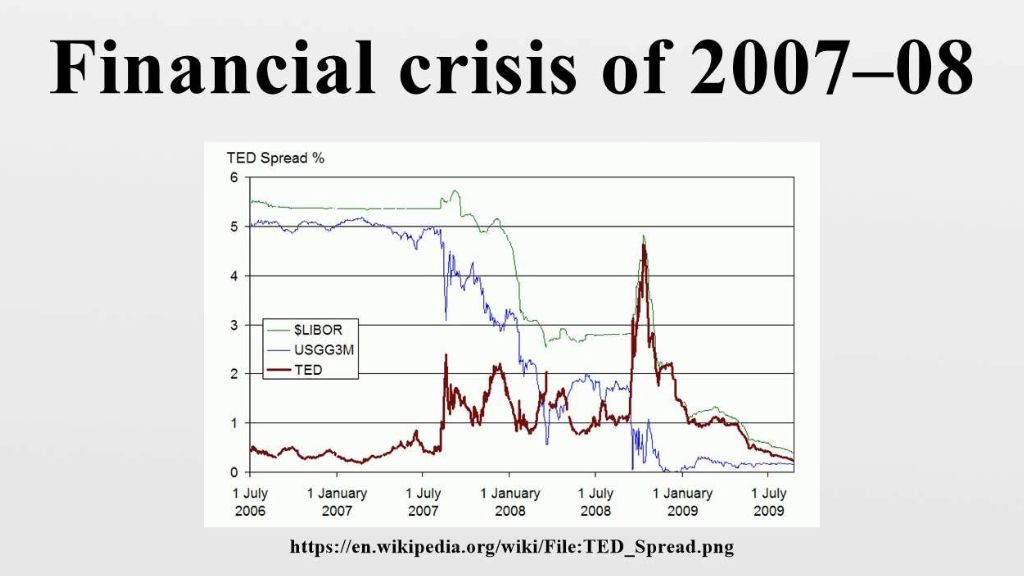

One of the most notable instances of risk management’s failure is the global financial crisis that struck the United States in 2007 and 2008. In the United States, banks and other lending organizations made loans to individuals without running credit checks during this period, which ultimately resulted in significant loan defaults. The world’s financial markets saw a severe collapse as a result of this event. It emphasizes the necessity of prudent risk management for institutional and individual investments.

The failure of risk management during the financial crisis in the United States and worldwide in 2007-2008. | Photo collected.

Why Risk Management is Important for Investors Above All

Risk management is important to everyone, not just professionals. Knowing the fundamentals of risk management and using them effectively will help you reduce losses and reach your financial objectives, regardless of your level of experience managing a portfolio.

Returns and risks are closely intertwined in financial transactions. Although high-risk investments typically yield higher returns, they can also result in greater losses if improperly managed. Investors may safeguard their money, boost profits, and build trust by implementing efficient risk management techniques.

Comments