| বাংলায় পড়ুন | Researchers and Reporters: Shama Sultana Isfaqul Kabir |

A Mobile Financial Service (MFS), SureCash provides a range of services, such as student stipends and government allowances. By offering MFS services, SureCash joined the market alongside Bkash, Nagad, and Rocket. Bkash, Nagad has attempted to introduce mobile financial services to the nation’s broad people, nevertheless. SureCash, on the other hand, concentrated more on digitizing the transactions of different corporate and public agencies. Only Rupali Bank currently offers MFS services to clients via SureCash, however, five banks earlier offered services to their clients through SureCash.

How SureCash got its start

Dr. Shahadat Khan, founder and CEO of Surecash. | Photo collected.

Munshiganj district is where Dr. Shahadat Khan, the founder and CEO of SureCash, was born. Bangladesh University of Engineering (BUET) is where he finished his education. He then began teaching at BUET, but because of his higher education, he relocated to America. Upon his return in 2006, he discovered that just 30% of the population had access to banking services. SureCash was founded primarily to offer mobile services to this demographic. SureCash launched in 2010.

What services does SureCash offer?

Initially, SureCash offered back-end services, software development, payment platforms, agent networks, and business development services. Moreover, SureCash enables any bank to offer its clients mobile banking services. In this instance, the first banks to trust SureCash were First Security Islami Bank and then Bangladesh Commerce Bank in 2012. To pay Wasa’s invoices, First Security Islami Bank and SureCash collaborated to introduce a mobile banking solution in 2014. Following that, Commerce Bank, National Credit, and Jamuna Bank each began offering their clients mobile banking services via SureCash.

SureCash’s expansion

A symbol of the growth and progress of Surecash. | Photo collected.

A Japanese e-commerce business makes its first investment in SureCash. The Osiris Group then contributed $7 million to SureCash in 2015. To pay student salaries, Dhaka College, Govt. Titumir College and numerous other educational institutions have agreements with SureCash. SureCash received the 2015 Bangladesh Bank “Award of Excellence” for their outstanding service. Apart from that, SureCash and Grameen Bank inked a deal in 2016 to offer small loans to their clients. SureCash assisted government bank Rupali Bank Limited in offering its clients mobile banking that same year. which is how the Rupali Bank SureCash app was made. Subsequently, the Ministry of Primary and Mass Education hired Rupali Bank SureCash to offer student scholarships. The government has relied on Rupali Bank SureCash to offer scholarships to students nationwide since 2017.

What’s wrong is SureCash

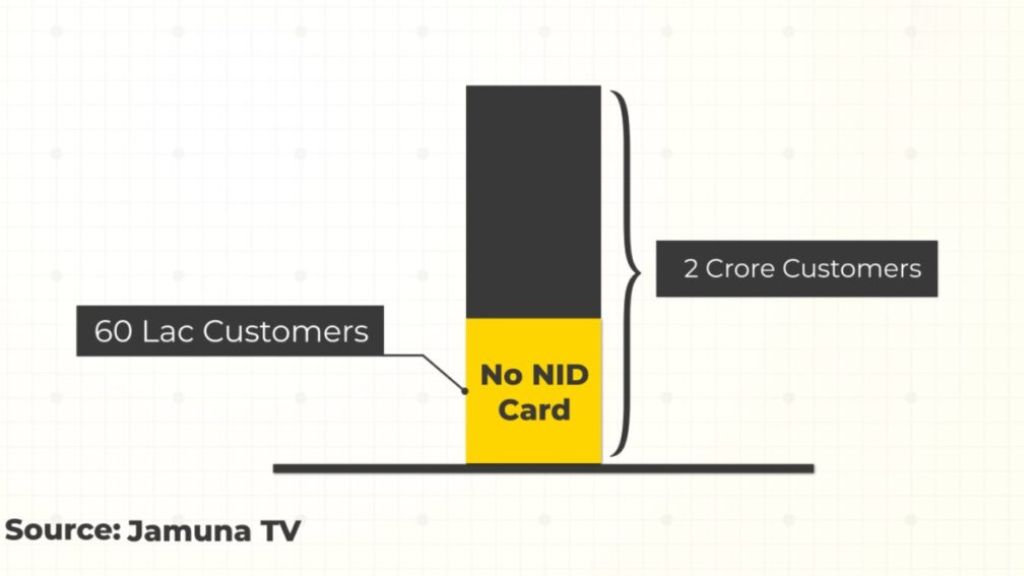

There are about 180,000 agents and about 2 crore customers with SureCash. contrary to a Bangladesh Bank inquiry report, SureCash has around 19 lakh outstanding accounts since back to 2016. where grants totaling 120 crores for students are stalled. In this context, the CEO of SureCash stated that the headmaster of the school requested that the funds be withheld because the children’s SIM cards were lost. To open an account, consumers must have a national identity card, per MFS rules.

The milestone of Surecash reaching nearly 20 million and 180 thousand customers. | Photo collected.

Yet, 60 lakh of SureCash’s 2 crore customers lack an NID, as reported by Jamuna TV. According to research published by The Business Standard, 37 SureCash accounts contain negative amounts.

It indicates that more money has been taken out of these accounts than has been put in. Regarding this, Bangladesh Bank stated that because of mistakes in the SureCash system, clients were able to take out more money from their account balance.

These instances caused the banks that worked with SureCash to terminate their agreements with SureCash one by one. Only Rupali Bank offers its clients mobile banking services via SureCash at this time.

Comments